For 2018 the ability to contribute to a roth ira begins to phase out for singles with a modified adjusted gross income of 120 000 and it gradually fades out to where you can t contribute to a.

Back door roth conversion 2018.

Deadline for a roth conversion 2018.

Presumably you are well under age 70.

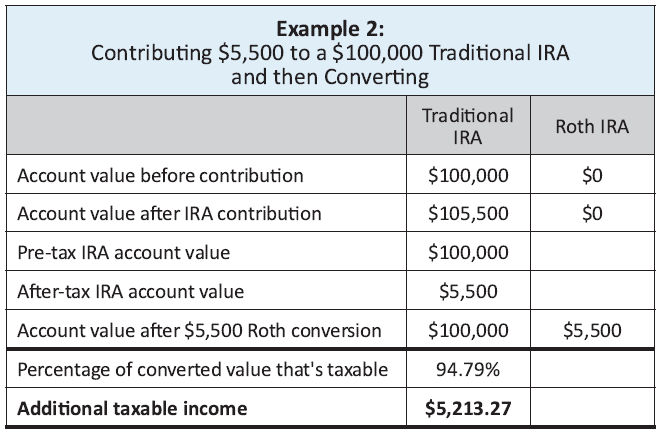

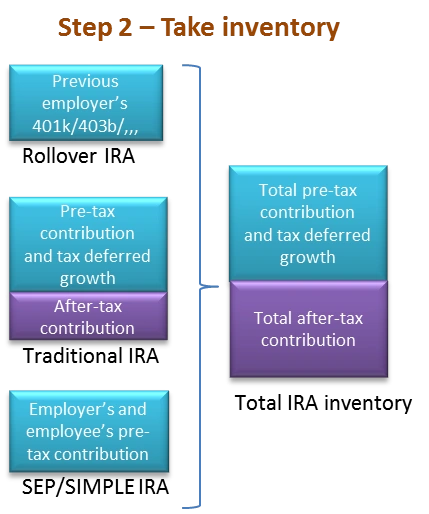

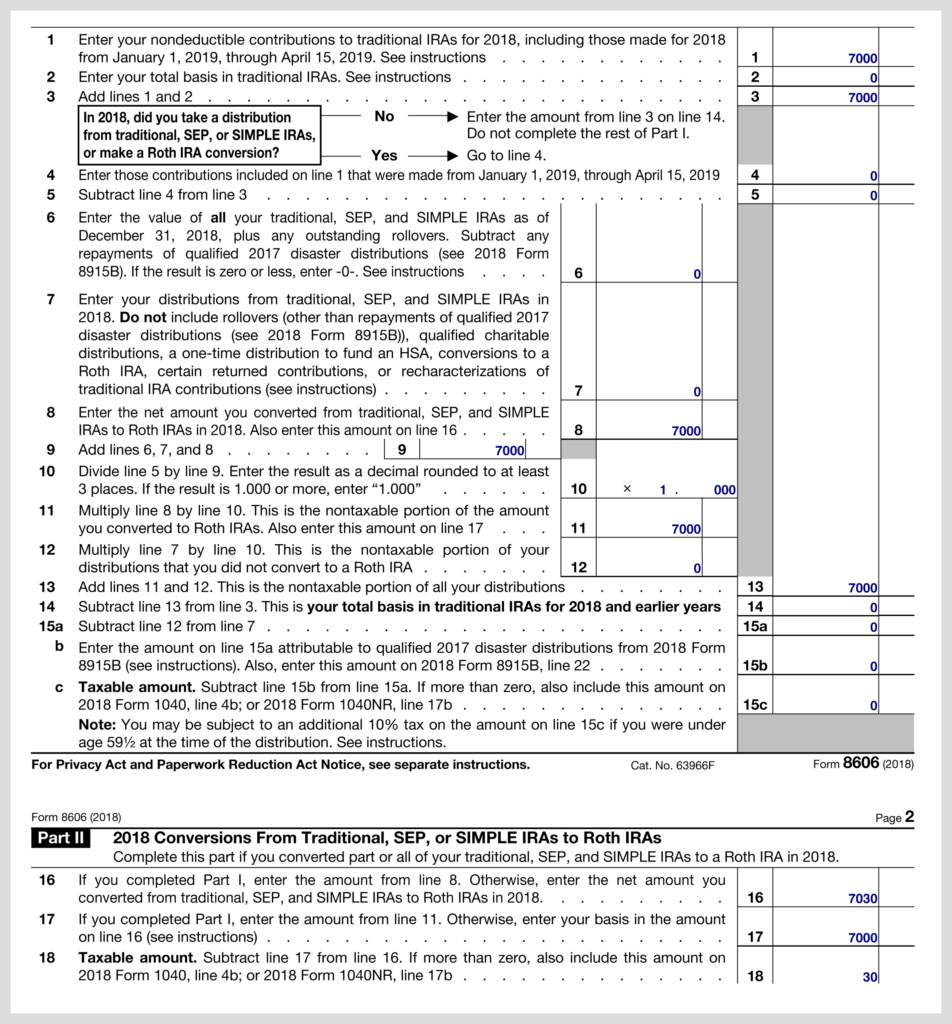

Backdoor roth ira conversion for 2018 2019 converted in 2019 in jan 2019 i made two non deductible contributions to traditional ira.

Some advisors suggest waiting a few months.

To contribute to a roth ira for 2018.

This threw me off as i thought the conversion would be under roth 2018 but the conversion did take place in 2019 so it ended up under roth 2019.

If you had sufficient compensation in 2018 to support a 5 500 contribution for 2018 yes you can make a 5 500 nondeductible traditional ira contribution for 2018 by april 15 2019.

A do over meant that you could do conversion and then undo the transaction up until oct.

You can do a roth conversion up until dec.

I was worried that when i contibute 6000 to 2019 tira then convert to roth it would hard stop me for going over the 2019 roth contribution limit.

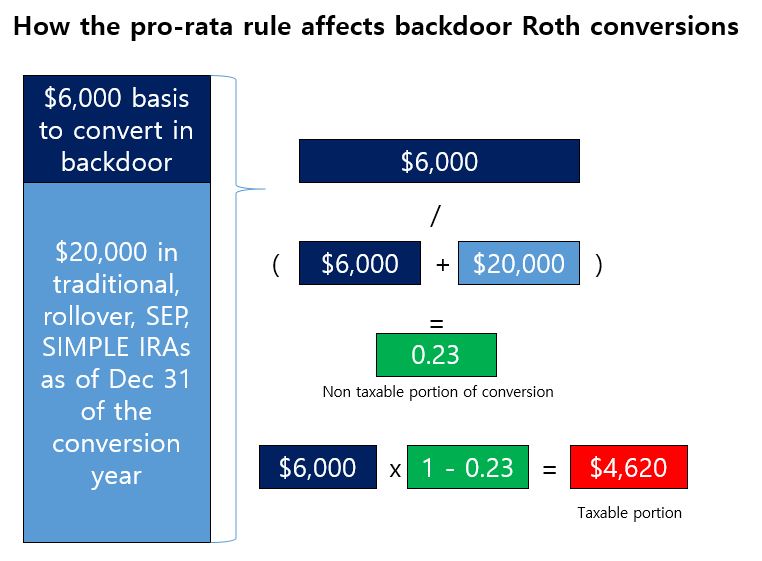

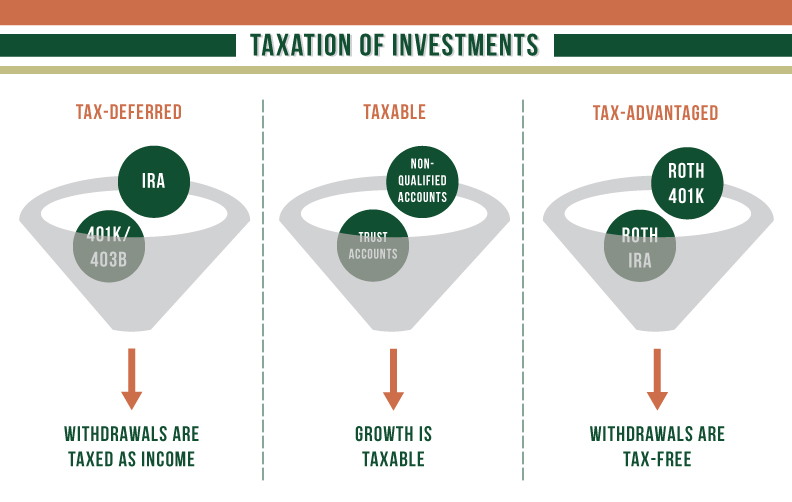

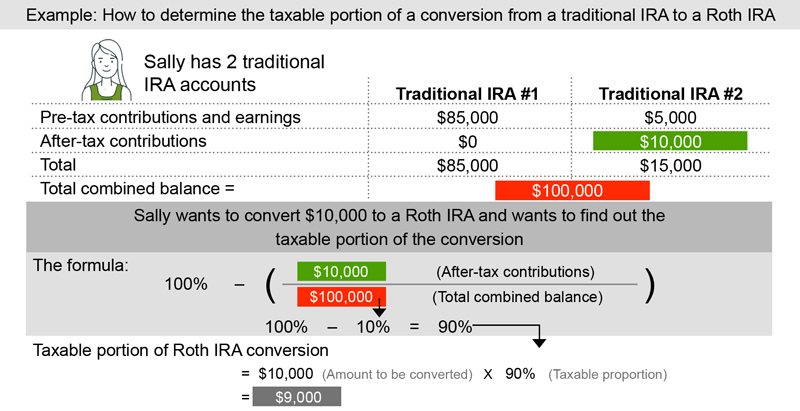

The tax consequences of a backdoor roth ira.

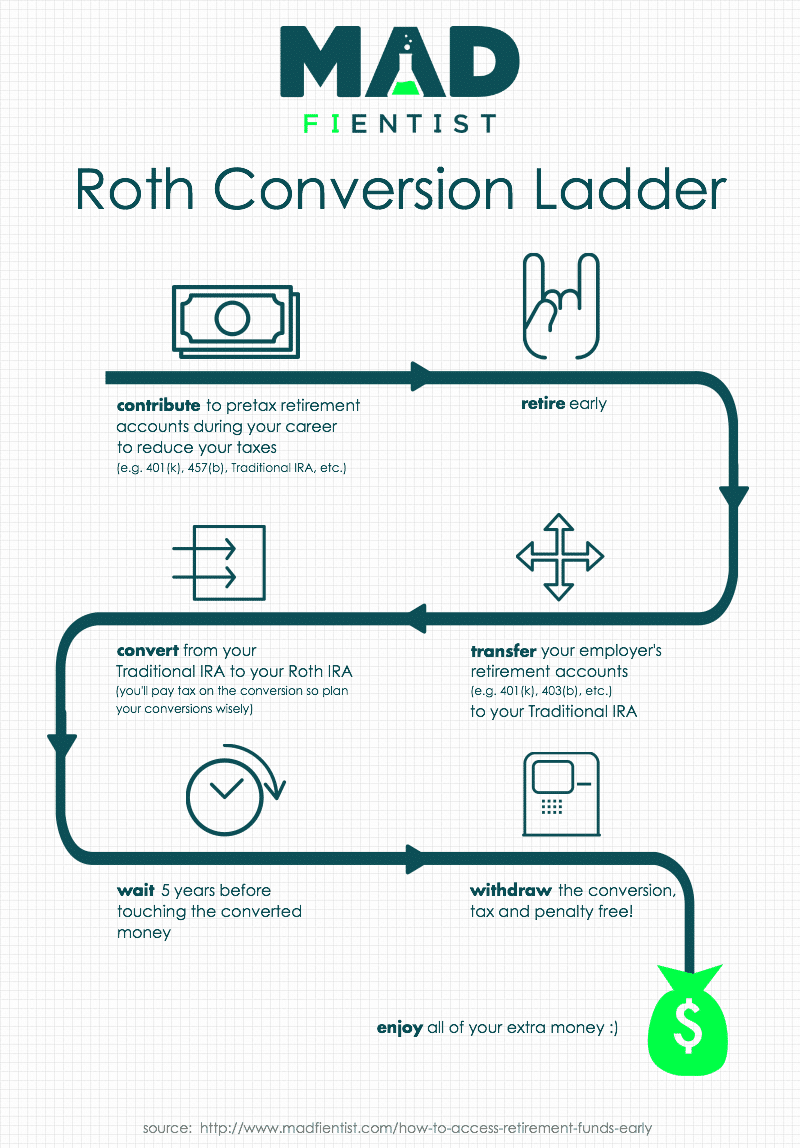

Notify your ira custodian trustee that you want to convert your traditional ira contribution to a roth ira and follow their instructions for doing so.

A method that taxpayers can use to place retirement savings in a roth ira even if their income is higher than the maximum the irs allows for regular roth ira contributions.

We love navigating complex issues like these and giving guidance to elevate your finances.

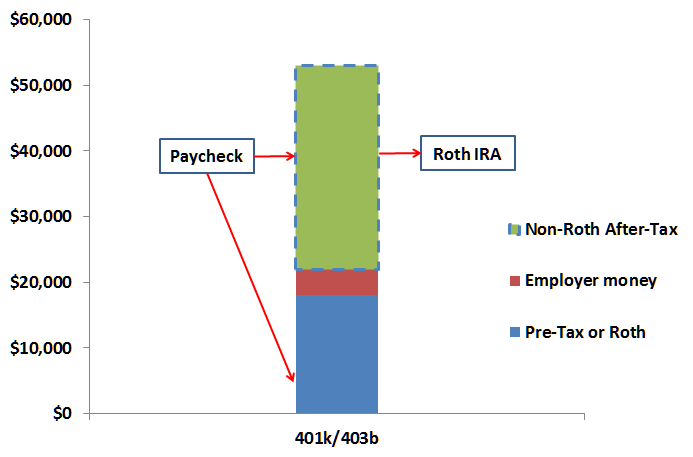

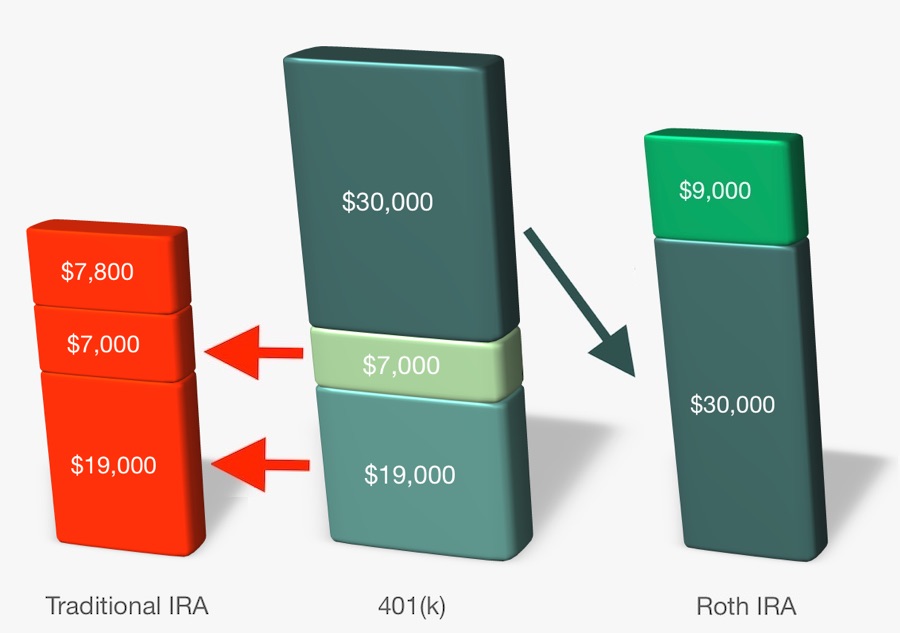

Check out mega backdoor roth explained to see how you might be able to do a backdoor roth in your employer 401 k plan.

This will result in the amount being moved to.

Only 10 of any conversion to a roth will be tax free and the remaining 90 will be taxable.

Transfer the assets from the traditional ira to a roth ira.

You can make this transfer and conversion at any point in the future.

Backdoor roth conversion for 2018 in 2019.

But if you.

Make sure you file irs form 8606 every year you do this.

15th in the following year if you decided that you wanted to avoid the tax hit.

The next day i then transferred 13 500 to roth ira for backdoor conversion.

One for 2018 6500 and 2nd for 2019 7000 i am 60 years.