Is there any special steps to follow to have this reported correctly i am planning to do the same contribution for 2017 before filing my return p p thanks p.

Back door roth ira conversion 2017.

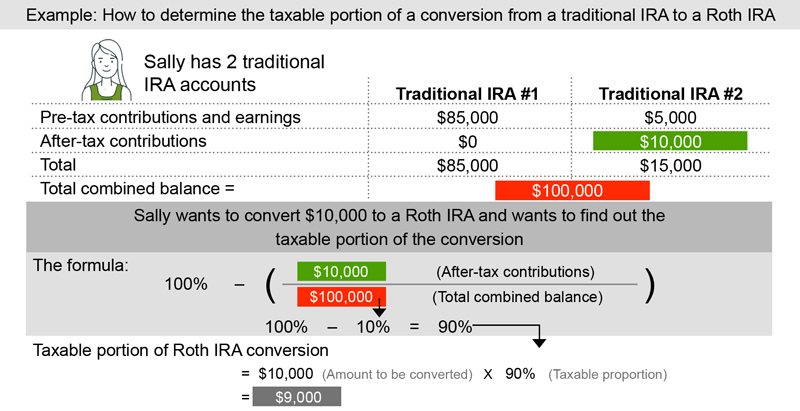

If taxpayer a withdraws 5 000 from the ira and rolls it into a roth 500 would be nontaxable 5 000 50 000 x 5 000 withdrawn as part of a conversion but 4 500 would be taxable 5 000 500.

More the complete guide to the roth ira.

You should contribute directly to a roth ira and avoid the backdoor conversion if your magi is below a certain amount.

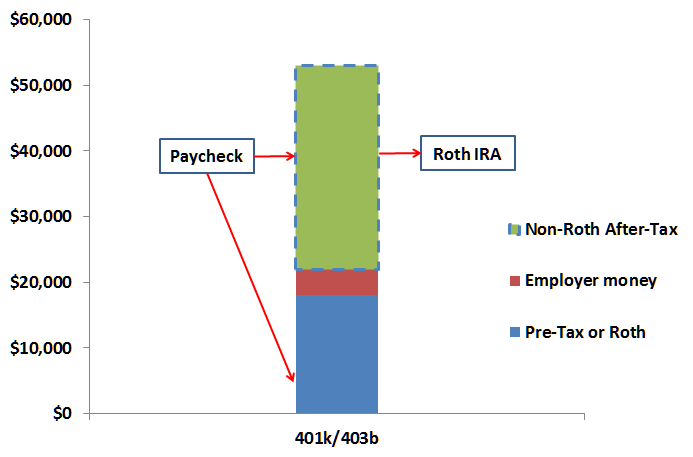

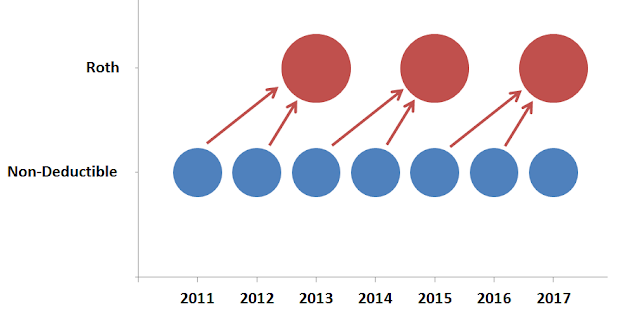

First place your contribution in a traditional ira which has no income limits.

A method that taxpayers can use to place retirement savings in a roth ira even if their income is higher than the maximum the irs allows for regular roth ira contributions.

Can you please elaborate on this edge case.

See publication 590 a contributions to individual retirement arrangements iras for more information.

Why would i have to pay tax if this is a post tax contribution.

Therefore you shouldn t ask your ira custodian or trustee for a backdoor roth ira contribution.

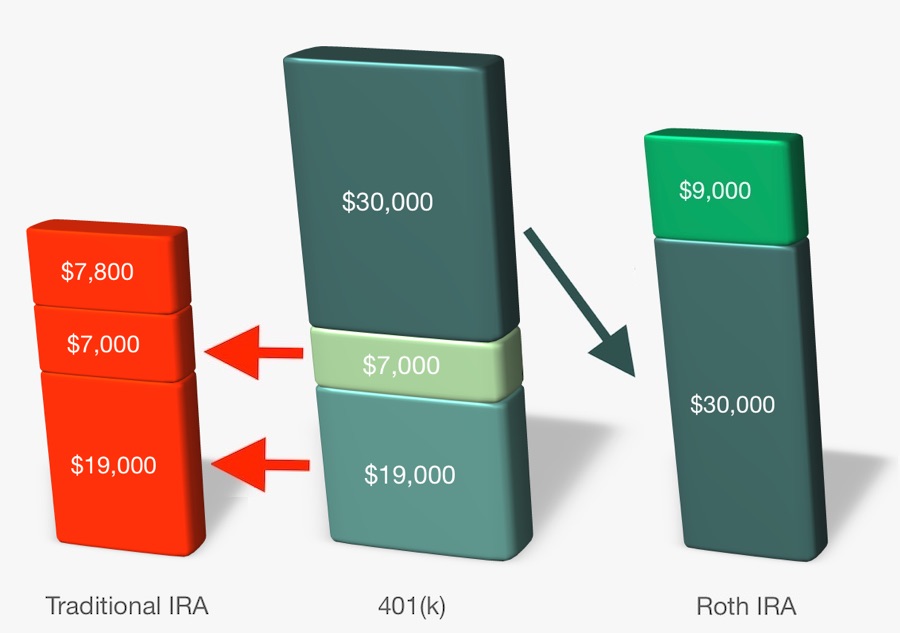

For instance if i roll my private ira into a company 401k today 1 11 2018 will i be able to star the back door roth strategy once that roll over is done guessing around 1 18 2018.

The 2020 tax year income limits are 124 000 for singles and 196 000 for.

The backdoor roth ira contribution is a strategy and not a product or a type of ira contribution.

But make sure you understand the tax consequences before using this strategy.

Return to iras faqs.

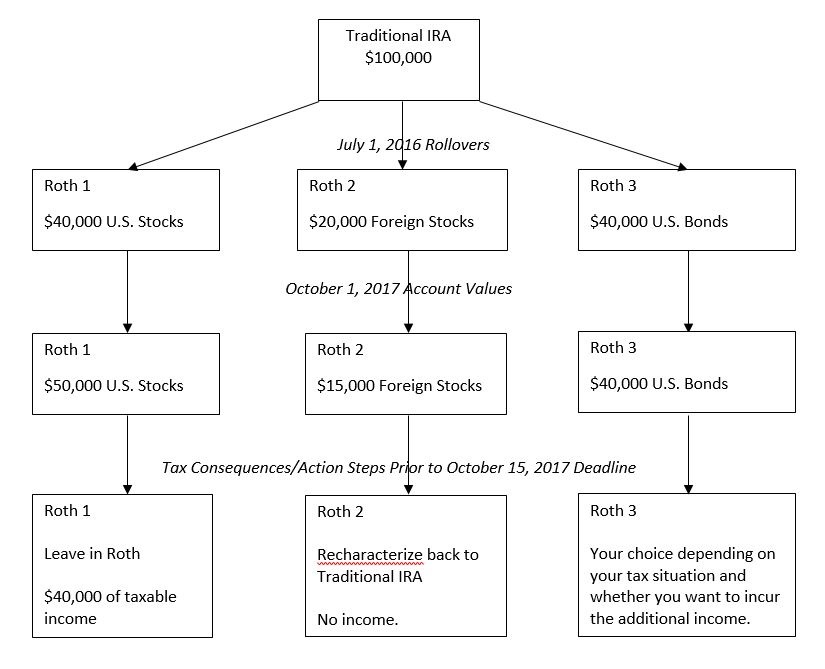

A conversion to a roth ira results in taxation of any untaxed amounts in the traditional ira.

A backdoor roth ira allows taxpayers to contribute to a roth ira even if their income is higher than the irs approved amount for such contributions.

Then move the money into a roth ira using a roth conversion.

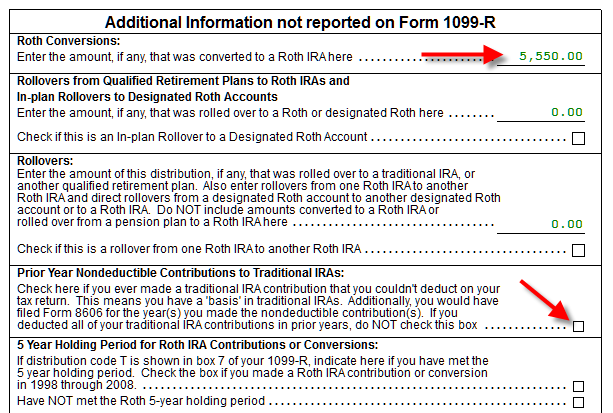

This is post tax ira for backdoor roth conversion.

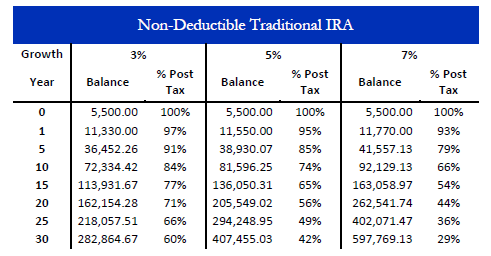

For example if your traditional ira balance is 20 000 after rolling over money from a 401 k and 2 000 is from nondeductible contributions only 10 of any conversion to a roth will be tax free.

When i imported 1099 r from my broker my owed tax amount went significantly high for 5500 contribution.