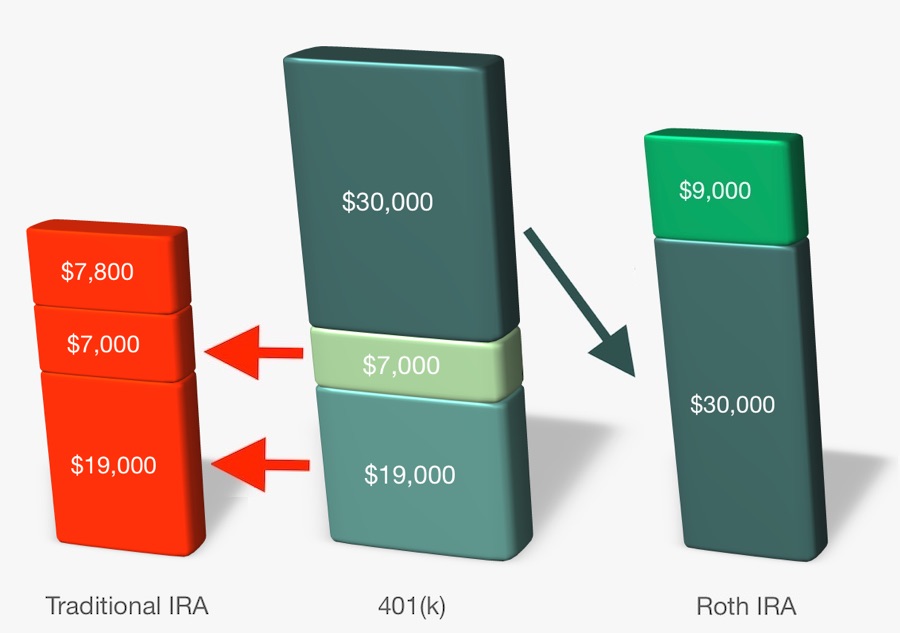

From there a roth ira conversion takes place letting those high income investors take advantage of tax free growth and future distributions without having to pay income taxes later on.

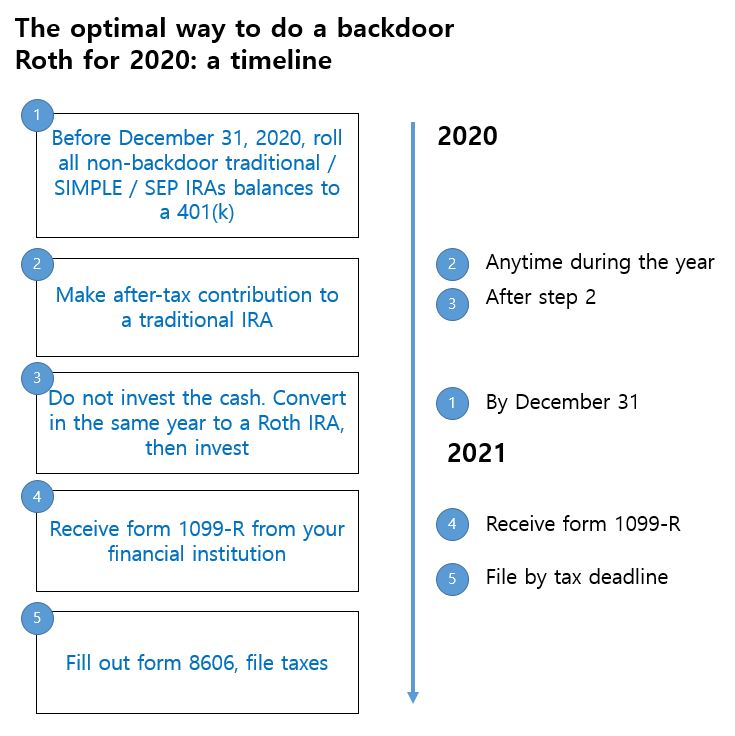

Backdoor roth ira conversion deadline.

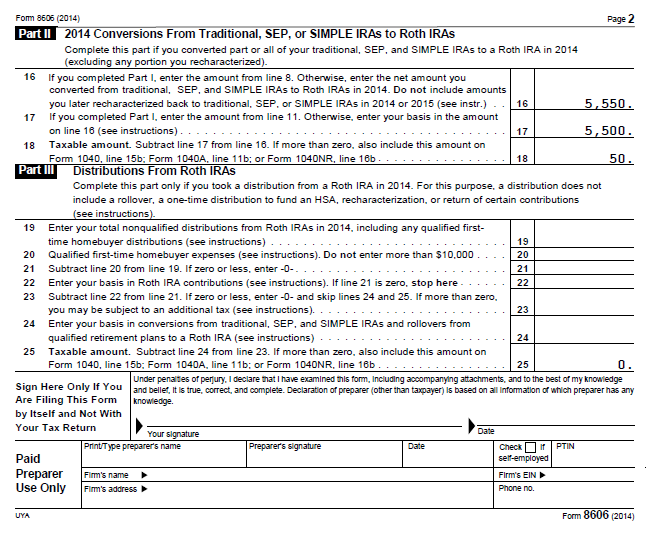

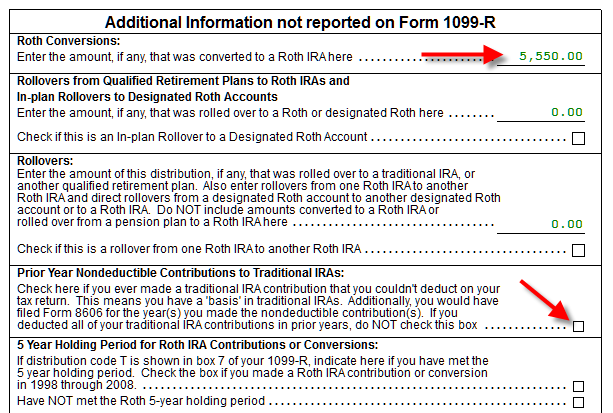

It will be reportable on your 2018 form 8606.

Look for the dropdown menu in the lower right labeled i want to and select convert to a roth ira.

In most years that magic date is april 15.

You are considered to have reached age 70 six.

For instance you are eligible to make a regular contribution to a traditional ira for 2019 only if you will not reach age 70 on december 31 2019.

Presumably you are well under age 70.

December 31 2019 for the 2019 tax year.

If you haven t filed your taxes for 2019 yet you have until.

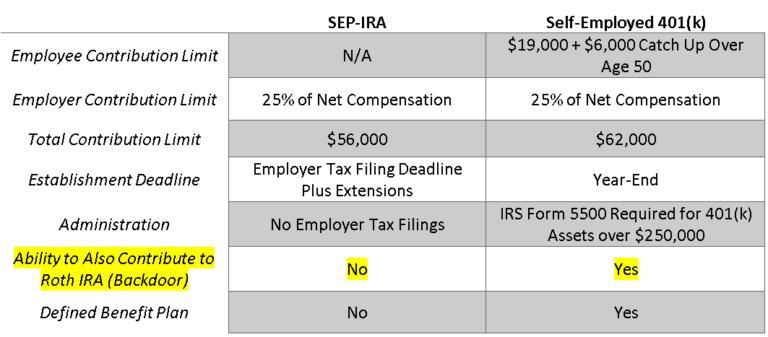

A backdoor roth ira can make sense in the same scenarios any roth ira conversion makes sense.

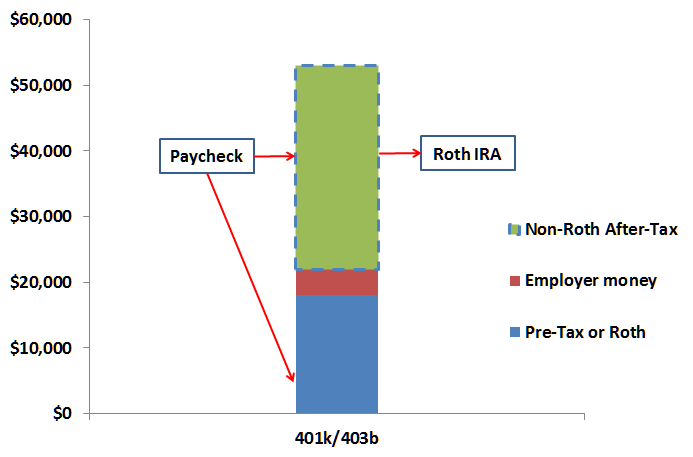

You can convert your traditional ira to a roth ira by.

Any potential tax deductions from the traditional ira contribution and the 6 000 remains in your taxable income for the year.

Two important annual deadlines are the roth ira conversion deadline december 31 and the deadline for contributions to an ira the due date for filing taxes around april 15 of the next year with.

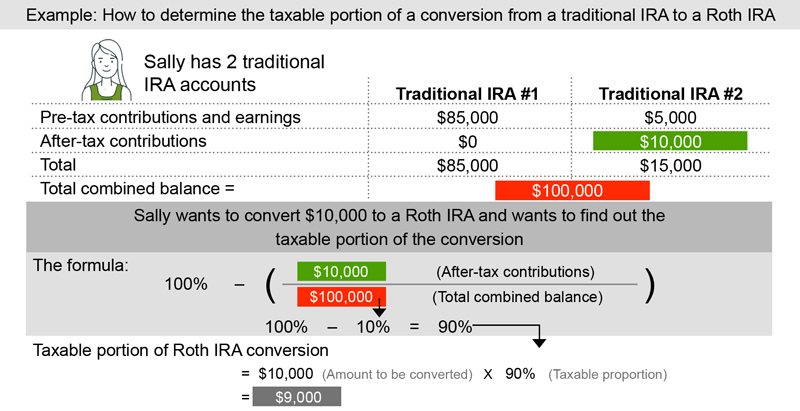

A method that taxpayers can use to place retirement savings in a roth ira even if their income is higher than the maximum the irs allows for regular roth ira contributions.

The net effect of the backdoor roth ira contribution is that the conversion eliminates the ability to make deductible ira contributions.

You have until the federal tax filing deadline each tax year to make ira contributions.

If you had sufficient compensation in 2018 to support a 5 500 contribution for 2018 yes you can make a 5 500 nondeductible traditional ira contribution for 2018 by april 15 2019.

If you ve decided on a roth ira conversion for your existing retirement account you can get started on your own or have one of our investment professionals help you every step of the way.

If you ve got an eligible spouse and by eligible i m referring to backdoor roth eligibility the two of you can sneak 24 000 into roth accounts this year as long as you complete the 2019 contribution by mid april 2020.

.jpg?width=400&name=Artboard%204%20(2).jpg)